In addition, Reflex regularly reports your card activity to major credit reporting agencies. However, as the card does not require good credit, it earns interest at a higher rate. Reflex Mastercard offers a quick and easy application process. Before submitting a completed application, you may review your prequalification status to determine if you are likely to be accepted for an account.

This pre-qualification is easy, free, and, most importantly, does not require a rigorous credit check. You can find out if you will be accepted without an application based on your credibility. There is no risk to your credit rating if you are not approved.

The Reflex Mastercard credit card offers a quick and easy application process. You can apply online through their secure 128-bit encrypted website, as well as over the phone or even by mail.

Follow The Given Registration Process

This is a complete description of how to register a Reflex credit card online account to easily run a credit card service or two before the end of each day. Just, follow the below-given steps:

- Open your web browser to log in to the Continental Finance Company platform.

- The URL is https://www.reflexcardinfo.com.

- Navigate to the top right corner of the page to click Reflex Credit Card Login.

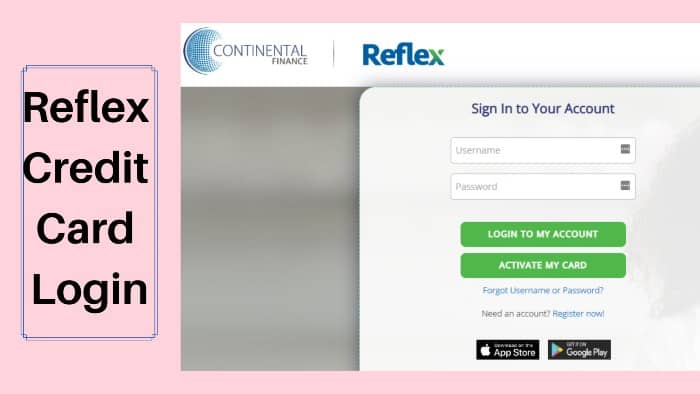

- Reflex credit card login image

- The Reflex Credit Card Login form will no doubt appear. Ignore registration requests and go to the bottom of the registration form to click Register my card.

- Click on this little link.

- A new page will open where you can open a credit card account.

- Fill in the open columns with the requested details.

- Submit the form after entering it.

- Try logging in to verify that your credit card account registration was successful.

Reflex Credit Card Login Procedure

Nothing could be simpler than connecting with a Reflex credit card. It’s the simplest of all.

- Just open your web browser and log on to www.reflexcardinfo.com/.

- Go to the top right corner of the homepage and click Reflex Credit Card Login.

- Enter your username in the first column.

- Fill in the second column with a saved password.

- Complete everything by bypassing the connect button.

- Congratulations! Welcome to the Reflex credit card platform. If you want to activate a new Reflex credit card, you can click Activate my card or follow this procedure to initiate a credit card activation.

What Are The Login Features?

- The credit limit of up to $1,000 is doubled to $2,000! (Just pay your first 6 minimum monthly payments on time.)

- See if you’re pre-qualified without affecting your credit score.

- All types of credit can be requested.

- Free access to your Experian Vantage 3.0 score (when you sign up for eStatements).

- Initial credit limit from $300 to $1,000 (depending on available credit).

- Monthly reports to the three major credit bureaus.

- Fast and easy application process; results in seconds.

- Use your card anywhere Mastercard is accepted.

- Current account required.

- Monthly fee of $0 for the first 12 months. $10.00 per month starting in year two does not apply to those with a $750 or $1,000 credit limit.

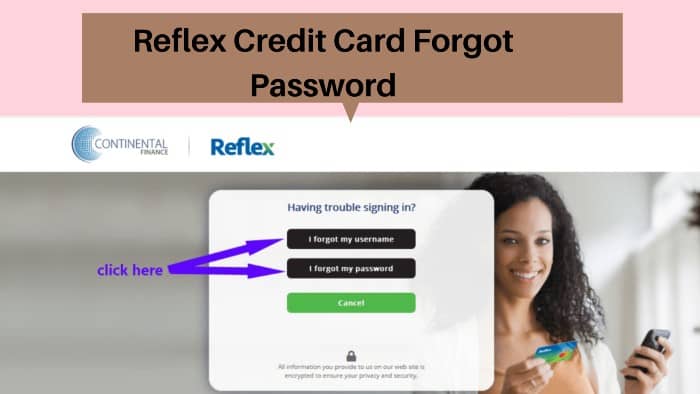

How To Retrieve Login Credentials?

Forgot Username

Step 1: Click the Forgot Username link at the top of the Reflex Credit Card Login page.

Step 2 – Next, enter your credit card account number.

Step 3 – Click Next Authentication and get your username on the following pages.

Password

Step 1 – Click Forgot Password? on the login page above.

Step 2 – Then enter your username.

Step 3 – Click Next Authentication and reset your password on the following pages.

How To Pay At Reflex Credit Card?

The best thing you can enjoy with any credit card is the ability to make payments through that credit card. The Reflex credit card is not excluded in this regard. This part of the article explains the different ways to pay with the Reflex credit card. There are currently three common payment methods for your My Reflex Card.

Online Payment Method

First, you can pay your Reflex MasterCard online, it is the most convenient way to pay with this credit card.

Step 1 – So, to make a payment using this method, you must be able to log into your account, as explained earlier in this article.

Step 2 – Then, you can select Make Payment.

Step 3 – Now, follow the onscreen instructions to pay your credit card from there.

Payment By Mail

Finally, you can choose to mail your payment. If you decide to do so, you can use the following address:

Reflex map

Field 6812

Carol Current, IL 60197-6812

Payment By Phone

Not only does this mean that online will solve the problem of paying with the Reflex Credit Card App, but it will also achieve the same goal by using a phone number.

Step 1 – To do this you need to call 1 800 518 6142 on your phone.

Step 2 – How to ask the operator to pay your credit card.

Step 3 – Then follow some simple instructions to complete your payment this way.

Take A Look At Reflex Benefits

Ease of Approval: If you don’t have a strong credit history, you may still be eligible for the My Reflex Card. The card company reports to all three major credit bureaus, so you can build a stronger credit history with this card and hopefully get approved for a better card.

- Potential credit limit increase after six months: While the maximum initial credit limit on the Reflex Card Login is $500, you are automatically eligible for a limit increase of up to $500 if you make six months of payments on time. If you continue to make timely payments after the first six months, you may receive a maximum limit of $2,000.

- No Deposit Possible: Many credit cards for bad Schufa applicants require you to make a deposit. This is not the case with the Reflex Card Login, although some applicants may need it.

- Immediate validation possible: For some candidates, there is an immediate validation of the Reflex Card Login.

Reflex Card Fees Structure

The Reflex card is expensive and has many fees. Consumers should think carefully about these fees before accepting a card offer.

- Annual fee: $75 – $99

- The Reflex card has high annual fees ranging from $75 to $99. With a maximum initial credit limit of just $500, this will significantly reduce your purchasing power.

- This means that if you get the $500 credit limit, you will be charged the annual fee and you will only have an available credit limit of $401 initially. To get an additional card, you pay a $30 fee to maintain your original balance limit, which would be reduced to $371.

Foreign Transaction Fee: 3%

There is an overseas transaction fee of 3% of total US dollar sales and no transaction fee for the first 12 months after account opening.

The Reflex card is one of the few bad credit cards that allow transactions abroad.

Cash Advance Fee: 5% or $5

If you use the Reflex Card for a cash advance, you will pay 5% of the cash advance amount or $5, whichever is greater. Again, like international transaction fees, cash advance fees are not charged for the first 12 months of account opening.

Late Payment Fee: $40

If you miss or delay a payment, a $40 fee will be charged in addition to the interest you pay on the purchase.

Monthly Maintenance Fee: $10 Per Month

Another fee to consider with the Reflex Card Info is the monthly maintenance fee, which is added to the annual fee.

The monthly maintenance fee is $120 per year, billed at $10 per month. You don’t have to pay this for the first 12 months after opening an account.

| Official Name | Reflex Credit Card |

|---|---|

| Portal Type | Login |

| Managed By | Continental Finance |

| Language | English |

| Country | USA |

About

The Reflex Credit Card offers the broad acceptance you’ve come to expect from a Mastercard. This account is accepted at most major online and in-person retailers, so you can use it for all your regular purchases. Account-holders are also protected with $0 fraud protection. You are never responsible for any unauthorized activity on your account, so you can feel safe using your card.

The Reflex Mastercard Login account includes a variable APR between 24.99% and 29.99% (variable). The same variable APR applies to cash withdrawals. There is also a 5% or $5 surcharge for cash withdrawals, so use this account feature wisely.

There are certain fees associated with this account. If your application is approved, you will pay an annual fee ranging from $75 to $99 per year.

There is also a monthly account fee of $10. This monthly fee is waived for the first year, so you don’t pay right away. Monthly fees are also waived for accounts with credit limits of $1,000 or more.

While this card has recurring account fees, there are no one-time fees. You do not pay enrollment fees, card fees, new cardholder fees, or other one-time charges.

Frequently Asked Questions

Can I manage my Reflex card account online?

If you can. All you need to do is sign up for online banking. You can pay your credit card bill, sign statements online, view recent transactions, view past statements, and view payment history and balances.

How do I check the status of my Reflex Mastercard Login order?

You cannot check the status of your order. You’ll know right away or you’ll have to wait up to 30 days for a response. The issuer may call you for more Reflex Card Info.

Can I get a cash advance with a Reflex credit card?

Yes, you can get a cash advance at an ATM. You can obtain your Cash Advance PIN by calling 866-449-4514.

What is the minimum monthly payment for the Reflex card?

The minimum Reflex Card Payment is 2% of your outstanding balance, including accrued interest and any other fees charged.

Where can I apply for a Reflex Mastercard Login?

Visit www.ReflexCardInfo.com for more details on your credit card benefits. Click the Apply Now button to open a short application to see if you qualify for the card. It only takes a minute to see your offers.

Customer Service

Below is the official Reflex Credit Card customer service phone number for Reflex Card Payment and other assistance:

- Reflex Card Payment and other support: 1-800-518-6142

- Reflex Credit Card Customer Service: 1-866-449-4514

- Automated Account Reflex Card Info: 1-866-449-4514

- Lost/stolen card: 1-800-556-5678

Billing address:

Reflex Card Payment on account

reflex map

DUST. Field 6812

Carol Current, IL 60197-6812

a reflex map

DUST. Field 3220

Buffalo, NY 14240-3220

Conclusion

It can assist people who are just starting out with their credit or who have experienced troublesome financial times to get back on track. This Reflex Credit Card App may be accessible to those who have been declined for other credit cards.

It is a very expensive credit card when it comes to its fees, even if you intend to pay off your monthly balance. In addition to the standard credit cards, there are alternative cards with lower annual fees and no monthly maintenance fees.